Our hosted solutions support financial institutions and fintechs connecting to Payment Schemes as well as IIPS operators needing to accelerate their deployment of a scheme.

This removes the technical burden of hosting the technology and compliments our capacity-building workshops, freeing you to evolve your business idea. When the time is right, we will support you to build capacity within your team to take over any process. See our capacity-building technical workshops for more details.

Our hosted offering is open source so you can trial it, evaluate it, and extend it with contributions back into the community and take it from the cloud to your self-hosted environment in the cloud or data center. Contact us and we will partner with you to get you testing labs in minutes or deployed, running, and transacting within days.

The solutions allow you to explore offering payment use cases such as:

- Bill payments (P2B/P2G)

- Inventory and business services (B2B)

- Merchant payments (P2B, including 3rd Party Payment Initiation needed by FinTech)

- Salaries and wages (B2P)

- Social disbursements (G2P)

- Taxes and fees (P2G)

- Transfers and remittances (P2P, including Account to Account)

A good reference for these use cases can be found in the ‘State of Inclusive Payment System in Africa 2022’ report published by AfricaNenda.

The environments operate with the full security model enabled

- Use best practice to support risk management

- Automated change management with reliable repeatable deployments

Leverage the INFITX expertise to accelerate your initiative while building capacity where you need it on your scheme journey.

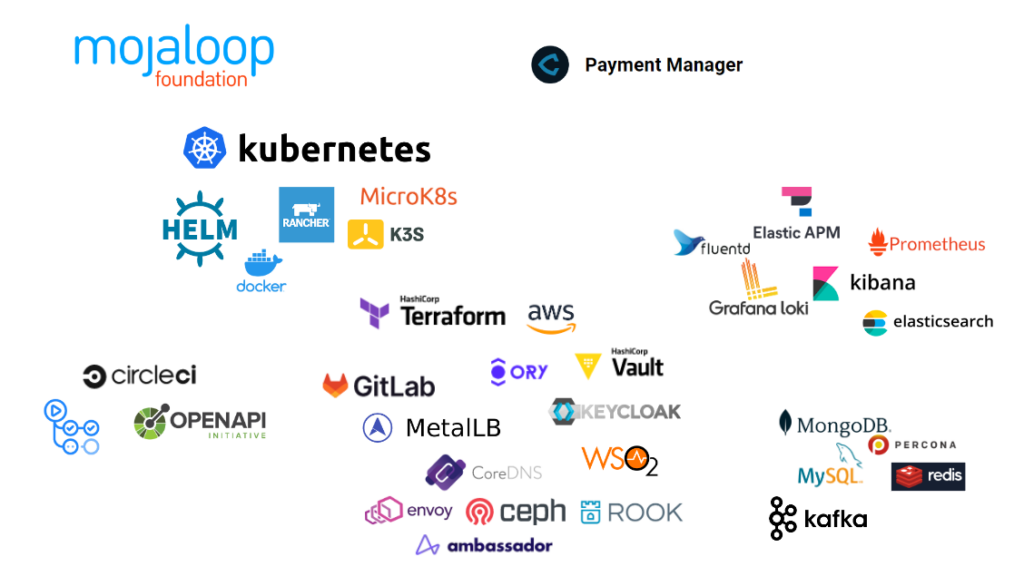

Some of the technical tools we will be using include…